Does Insulation Qualify For Energy Credit . home insulation, up to $5,000: add insulation to at least 20% of your exterior wall area, excluding foundation walls. homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. for the energy efficient home improvement credit, the following requirements apply: insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. Common types of eligible insulation include foam board, loose fill,. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and.

from insulation.org

Common types of eligible insulation include foam board, loose fill,. home insulation, up to $5,000: homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. for the energy efficient home improvement credit, the following requirements apply: the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. add insulation to at least 20% of your exterior wall area, excluding foundation walls. insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and.

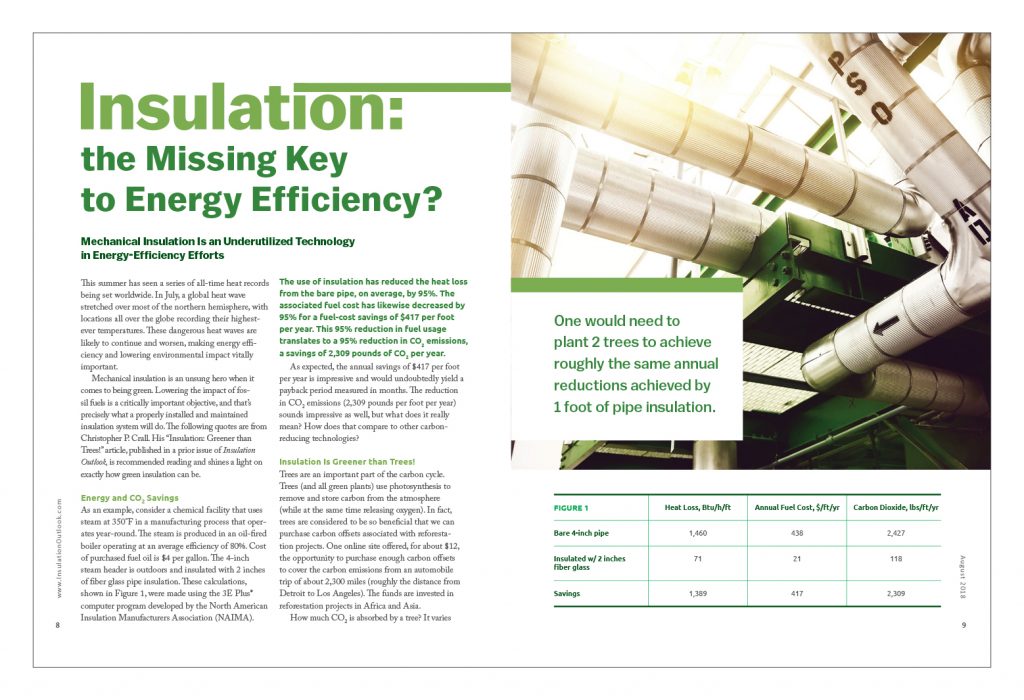

Insulation the Missing Key to Energy Efficiency Insulation Outlook Magazine

Does Insulation Qualify For Energy Credit Common types of eligible insulation include foam board, loose fill,. homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. for the energy efficient home improvement credit, the following requirements apply: Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. Common types of eligible insulation include foam board, loose fill,. home insulation, up to $5,000: the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. add insulation to at least 20% of your exterior wall area, excluding foundation walls.

From shoreinsulation.com

Federal Tax Credit Info Shore Insulation Does Insulation Qualify For Energy Credit add insulation to at least 20% of your exterior wall area, excluding foundation walls. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. for the energy efficient home improvement credit, the following requirements apply: Common types of eligible insulation include foam board, loose fill,. home insulation, up to $5,000:. Does Insulation Qualify For Energy Credit.

From allweather-insulation.com

Insulation Tax Credits Are Available Allweather Insulation Does Insulation Qualify For Energy Credit Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. Common types of eligible insulation include foam board, loose fill,. for the energy efficient home improvement credit, the following requirements. Does Insulation Qualify For Energy Credit.

From www.kangaroocontractors.com

Insulation Tax Credits Eligible for insulation tax credit Does Insulation Qualify For Energy Credit add insulation to at least 20% of your exterior wall area, excluding foundation walls. home insulation, up to $5,000: homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. for the energy efficient home improvement credit, the following requirements apply:. Does Insulation Qualify For Energy Credit.

From insulation.org

Insulation Energy Appraisals The Economics of Insulating for Energy Savings Insulation Does Insulation Qualify For Energy Credit homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. Common types of eligible insulation include foam board, loose fill,. add insulation to at least 20% of your exterior wall area, excluding foundation walls. Upgrade your eligible attic, cathedral ceiling, flat roof,. Does Insulation Qualify For Energy Credit.

From www.progressivefoam.com

Insulated Siding Tax Credit 2018 Does Insulation Qualify For Energy Credit for the energy efficient home improvement credit, the following requirements apply: Common types of eligible insulation include foam board, loose fill,. insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their. Does Insulation Qualify For Energy Credit.

From www.insulwise.com

Insulation Tax Credit for 2023! Insulwise Does Insulation Qualify For Energy Credit Common types of eligible insulation include foam board, loose fill,. homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. add insulation to at least. Does Insulation Qualify For Energy Credit.

From leedinsulation.net

Insulation Tax Credits are Available Leed Insulation Does Insulation Qualify For Energy Credit add insulation to at least 20% of your exterior wall area, excluding foundation walls. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. Common types of eligible insulation include foam board, loose fill,. homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to. Does Insulation Qualify For Energy Credit.

From storables.com

What Insulation Qualifies For Energy Tax Credit Storables Does Insulation Qualify For Energy Credit homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. home insulation, up to $5,000: add insulation to at least 20% of your exterior. Does Insulation Qualify For Energy Credit.

From mantledev.com

Mantle Developments Which insulation most effectively reduces wholelife carbon (embodied and Does Insulation Qualify For Energy Credit the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. home insulation, up to $5,000: Common types of eligible insulation include foam board, loose fill,. insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. homeowners will be able to receive grants. Does Insulation Qualify For Energy Credit.

From www.callsmarthouse.com

Infographic How Insulation Boost Your Energy Efficiency SmartHouse Does Insulation Qualify For Energy Credit home insulation, up to $5,000: Common types of eligible insulation include foam board, loose fill,. for the energy efficient home improvement credit, the following requirements apply: insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. the inflation reduction act of 2022 (ira) amended the credits for energy. Does Insulation Qualify For Energy Credit.

From devereinsulationhomeperformance.com

Insulation Tax Credits Are Available DeVere Insulation Home Performance Does Insulation Qualify For Energy Credit home insulation, up to $5,000: Common types of eligible insulation include foam board, loose fill,. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. add insulation to at least 20% of your exterior wall area, excluding foundation walls. homeowners will be able to receive grants of up to $5,000. Does Insulation Qualify For Energy Credit.

From greenecon.net

Heating and Cooling Does Insulation Pay? Does Insulation Qualify For Energy Credit for the energy efficient home improvement credit, the following requirements apply: homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. Common types of eligible insulation include foam board, loose fill,. insulation tax credit this tax credit is effective for products. Does Insulation Qualify For Energy Credit.

From fabalabse.com

How do I know if I am eligible for energy rebate? Leia aqui What qualifies for federal energy Does Insulation Qualify For Energy Credit homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. add insulation to at least 20% of your exterior wall area, excluding foundation walls. Common types of eligible insulation include foam board, loose fill,. the inflation reduction act of 2022 (ira). Does Insulation Qualify For Energy Credit.

From www.slideteam.net

Energy Tax Credit Insulation In Powerpoint And Google Slides Cpb Does Insulation Qualify For Energy Credit the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. home insulation, up to $5,000: homeowners will be able to receive grants of up to $5,000 to make energy efficient retrofits to their primary residences, and up to $600 to help. for the energy efficient home improvement credit, the following. Does Insulation Qualify For Energy Credit.

From insulation.org

Insulation the Missing Key to Energy Efficiency Insulation Outlook Magazine Does Insulation Qualify For Energy Credit add insulation to at least 20% of your exterior wall area, excluding foundation walls. for the energy efficient home improvement credit, the following requirements apply: home insulation, up to $5,000: Common types of eligible insulation include foam board, loose fill,. Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. insulation tax credit this. Does Insulation Qualify For Energy Credit.

From clarisenergy.com

Calculate the Energy Tax Credit for Residential Improvements Does Insulation Qualify For Energy Credit add insulation to at least 20% of your exterior wall area, excluding foundation walls. insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. for the energy efficient home improvement credit, the following requirements apply: home insulation, up to $5,000: Upgrade your eligible attic, cathedral ceiling, flat roof,. Does Insulation Qualify For Energy Credit.

From www.truteam.com

Insulation Tax Benefits, Rebates, & Credits TruTeam Does Insulation Qualify For Energy Credit Common types of eligible insulation include foam board, loose fill,. the inflation reduction act of 2022 (ira) amended the credits for energy efficient home improvements and. Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. home insulation, up to $5,000: homeowners will be able to receive grants of up to $5,000 to make energy. Does Insulation Qualify For Energy Credit.

From markham-norton.com

Making Home Improvements May Qualify for Home Energy Credits Does Insulation Qualify For Energy Credit for the energy efficient home improvement credit, the following requirements apply: insulation tax credit this tax credit is effective for products purchased and installed between january 1, 2023, and. home insulation, up to $5,000: Upgrade your eligible attic, cathedral ceiling, flat roof, exterior wall, exposed floor,. homeowners will be able to receive grants of up to. Does Insulation Qualify For Energy Credit.